Category: Tech Valuation Bubble

-

How Blackberry Screwed Good Technology’s Employees

This came up in a meeting a couple days ago. Good Technology was valued at $1.1B. Blackberry bought it at huge discount from it’s value and the employees got screwed: Around 9 a.m., hundreds of employees filed into a conference room or started up videoconference software to watch Good’s chief executive, Christy Wyatt, discuss the sale. Ms. […]

-

The New Yorker Drops a Bomb on Twitter

Social media is a scale game or a product game, and Twitter is failing at both.

-

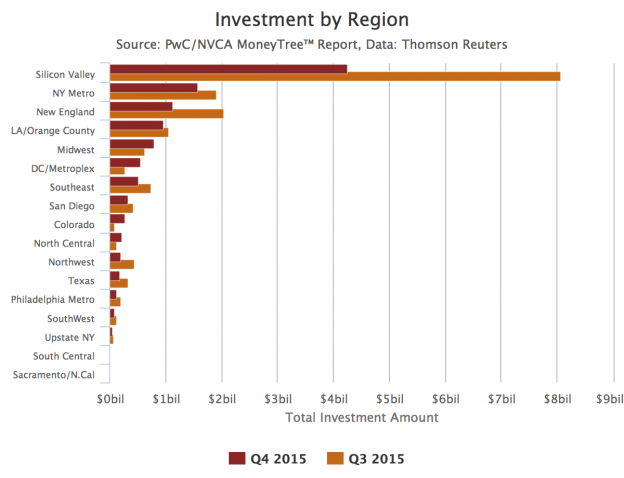

PWC: VC Investment Drops By 47% in Q4 2015

PWC sees deal volume and amount drop considerably from Q3 to Q4 of 2015.

-

Unicorns vs Donkeys: Let’s Do the Math

Lifetime value of customer divided by cost of customer acquisition should be more than 3.